Welcome Blessings!

(Tap 🔽 to see more topics!)

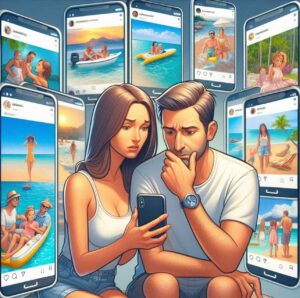

The scroll of endless scrolling, a highlight reel of everyone else’s ‘perfect’ life, whispers promises of happiness tied to things you can buy. The spending traps of social media are real, and they’re everywhere. In our pockets and purses, we carry tiny portals to a world where everyone seems to be living their best life. A life often showcased through the lens of carefully curated purchases. Social media, a tool meant to connect us, has become a marketplace of desires, subtly nudging us toward spending habits that can strain even the most substantial relationships.

It’s not just about the flashy ads. Also, it’s about the constant exposure to a lifestyle that feels just out of reach, sparking that nagging feeling of “I need that too.” It can lead to a cycle of comparison, impulsive buys, and a growing disconnect between our financial situation and the picture-perfect world we see online. For couples, this can translate into hidden debts, arguments over spending, and a creeping sense of economic anxiety. But the good news is you don’t have to be a victim of the algorithm.

By understanding the common traps social media sets and grounding ourselves in time-tested principles, we can regain control of our finances and protect our marriages from unnecessary pressure. Let’s dig into seven standard social media spending snares, explore how they can damage your partnership, and discover how timeless wisdom can provide a solid foundation for financial harmony.

The “Keeping Up With the Joneses” Trap

In the age of social media, it’s easy to feel like you need to keep up with others. You scroll through your feed and see friends and influencers posting about their new homes, luxury vacations, or the latest gadgets. It can create the feeling that your life is somehow less significant or fulfilling if you’re not living up to these perceived standards.

But social media is often a curated highlight reel. People post what they want others to see… the best moments, the big purchases, and the “perfect” experiences. They don’t show the struggles or the behind-the-scenes sacrifices that come with living that lifestyle.

Biblical Insight:

The Bible warns us against coveting what others have, as it leads to discontentment and poor financial decisions.

“You shall not covet your neighbor’s house. You shall not covet your neighbor’s wife, or his male servant, or his female servant, or his ox, or his donkey, or anything that is your neighbor’s.” – Exodus 20:17

Instead of comparing yourself to others, focus on your blessings and what you and your spouse can build together.

How to Protect Your Marriage:

Talk with your partner about your shared financial goals. Are you saving for a house, planning a vacation, or building an emergency fund? When you have a shared vision, resisting the urge to overspend on fleeting desires is easier.

The Impulse Buy Trap

One of the biggest temptations on social media is the ease of impulse buying. With just a few taps, you can purchase the latest trending item or take advantage of a “limited-time” sale. Social media ads are designed to trigger your emotions, pushing you to act before you have time to think. Impulsive purchases might seem harmless, but they can quickly add up, especially if they become a pattern. Before you know it, the budget is off-track, and the financial strain starts to build.

Biblical Insight:

The Bible encourages wisdom and careful consideration before purchasing, emphasizing the importance of living within your means.

“The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.” – Proverbs 21:5

Impulse buying often leads to regret and financial distress. Instead of giving into the immediate desire, reflect before making a purchase.

How to Protect Your Marriage:

Create a rule with your spouse to wait 24 hours before buying anything non-essential. This cooling-off period helps you evaluate whether the item is necessary and aligns with your financial goals.

The “Perfect Life” Trap

Social media often presents a polished, idealized version of life. You might see influencers or couples posting perfectly filtered pictures of their vacations, family events, or luxurious purchases. While this portrayal of the “perfect life” can be inspiring, it can also create unrealistic expectations, leading to financial pressure.

You might be tempted to spend more time reliving these picture-perfect moments, thinking this is what happiness and success look like. But perfection on social media doesn’t equate to fulfillment in real life.

Biblical Insight:

The Bible teaches contentment with what we have and warns against the dangers of greed and the pursuit of materialism.

“But godliness with contentment is great gain. For we brought nothing into the world, and we can take nothing out of it.” – 1 Timothy 6:6-7

True happiness comes not from material stuff but from living content with what God has provided.

How to Protect Your Marriage:

Instead of trying to match the perfect moments on social media, focus on what brings joy to your relationship. Simple activities like cooking dinner together, taking walks, or enjoying a quiet night at home can strengthen your bond without draining your finances.

The Celebrity Endorsement Trap

From Instagram ads to TikTok videos, social media influencers and celebrities often endorse products and services, making them seem desirable and necessary for a fulfilling life. Whether it’s a luxury skincare product, a new fashion trend, or an expensive gadget, these endorsements can lead to the belief that these items are the key to happiness or success.

However, many of these endorsements are paid advertisements, and the items promoted may not align with your personal needs or budget.

Biblical Insight:

The Bible warns against being led astray by the pursuit of material wealth or following trends just for the sake of appearance.

“Do not store up for yourselves treasures on earth, where moths and vermin destroy, and where thieves break in and steal.” – Matthew 6:19

Instead of chasing the latest trends, focus on what is of eternal value and will truly benefit you and your family.

How to Protect Your Marriage:

Before purchasing based on an influencer’s endorsement, consider whether it’s truly something you need or just a passing desire. Be sure that your spending aligns with your long-term financial goals.

The FOMO (Fear of Missing Out) Trap

We all know that social media is a breeding ground for FOMO—the fear of missing out. Whether it’s the latest party, concert, or shopping sale, you might feel pressured to participate in everything, fearing that you’ll be left out. Thus, it can lead to unnecessary spending as you try to keep up with what everyone else is doing.

FOMO encourages reactive spending, where decisions are made based on external pressures rather than thoughtful planning. It’s easy to get swept up in the moment, but this spending often leads to regret and financial strain.

Biblical Insight:

The Bible teaches us to be content and trust God’s timing for our lives rather than trying to keep up with others.

“I have learned to be content whatever the circumstances.” – Philippians 4:11

We don’t need to be everywhere or do everything to be happy. Contentment comes from knowing that God has a plan for us, and we don’t need to chase the latest trends to find fulfillment.

How to Protect Your Marriage:

Instead of succumbing to FOMO, focus on your priorities as a couple. Discuss what activities and experiences matter most to you, and make financial decisions that align with those values.

The Oversharing Trap

Many people use social media to share their lives—vacations, family moments, new purchases, and personal achievements. However, oversharing can cause unnecessary pressure and comparison when it comes to finances. When you see others flaunting their latest purchases or extravagant lifestyles, you may feel the need to compete, leading to spending beyond your means.

Biblical Insight:

The Bible reminds us to be cautious about our sharing motivations and live with wisdom and discernment.

“Let your light shine before others, that they may see your good deeds and glorify your Father in heaven.” – Matthew 5:16

Our actions should reflect our values, not the need for validation from others. Oversharing on social media can detract from the peace and contentment that God desires for us.

How to Protect Your Marriage:

Be mindful of what you share on social media. Instead of focusing on external validation, prioritize your internal well-being and the health of your marriage. Make financial decisions based on what’s best for your family, not what others think.

The Instant Gratification Trap

Lastly, social media fosters a culture of instant gratification, where we’re constantly bombarded with ads, notifications, and temptations to buy things now. This “buy now, pay later” mentality can lead to impulsive spending, accumulating debt, and eventually causing financial strain in your marriage.

Biblical Insight:

The Bible speaks against the desire for instant gratification and encourages patience and self-control.

“The wise store up choice food and olive oil, but fools gulp theirs down.” – Proverbs 21:20

The Bible teaches us to be patient and prudent in our decisions, particularly regarding finances. Instant gratification rarely leads to lasting contentment.

How to Protect Your Marriage:

Instead of acting on impulse, practice patience. Discuss larger purchases with your spouse and ensure they align with your long-term financial goals. This will help you avoid unnecessary debt and ensure your spending is aligned with your values.

The endless scroll doesn’t have to write your family’s financial story. We all know that some people may feel envious when they see someone else’s seemingly perfect life online. But remember, those carefully curated moments don’t tell the whole story. It’s easy to fall into the trap of trying to keep up, to chase that fleeting feeling of “having it all,” but real happiness isn’t bought with likes or shares. It’s built on a foundation of shared dreams, honest conversations, and a partnership that values “us” over “stuff.”

Think of your marriage like a garden. It needs tending, patience, and a bit of weeding to thrive. By recognizing the subtle ways social media can push us toward impulsive spending and by grounding our choices in values that truly matter, we can cultivate a financial peace that strengthens our bond, not weakens it. Let’s put down the phone for a moment, look into the eyes of the person we love, and remember what’s truly important. Voila! Until next time!